Irs Letter 12c 2024 – The Internal Revenue Service has announced that income tax brackets and standard deductions will be changing come the 2024-2025 season. The IRS released the information Thursday in its annual . The 2024 limits come after the IRS last year expanded its tax brackets by a historically large 7%, reflecting last year’s high inflation. The IRS adjusts tax brackets annually — as well as many .

Irs Letter 12c 2024

Source : form-12c-meaning.pdffiller.com

3.10.72 Receiving, Extracting, and Sorting | Internal Revenue Service

Source : www.irs.gov

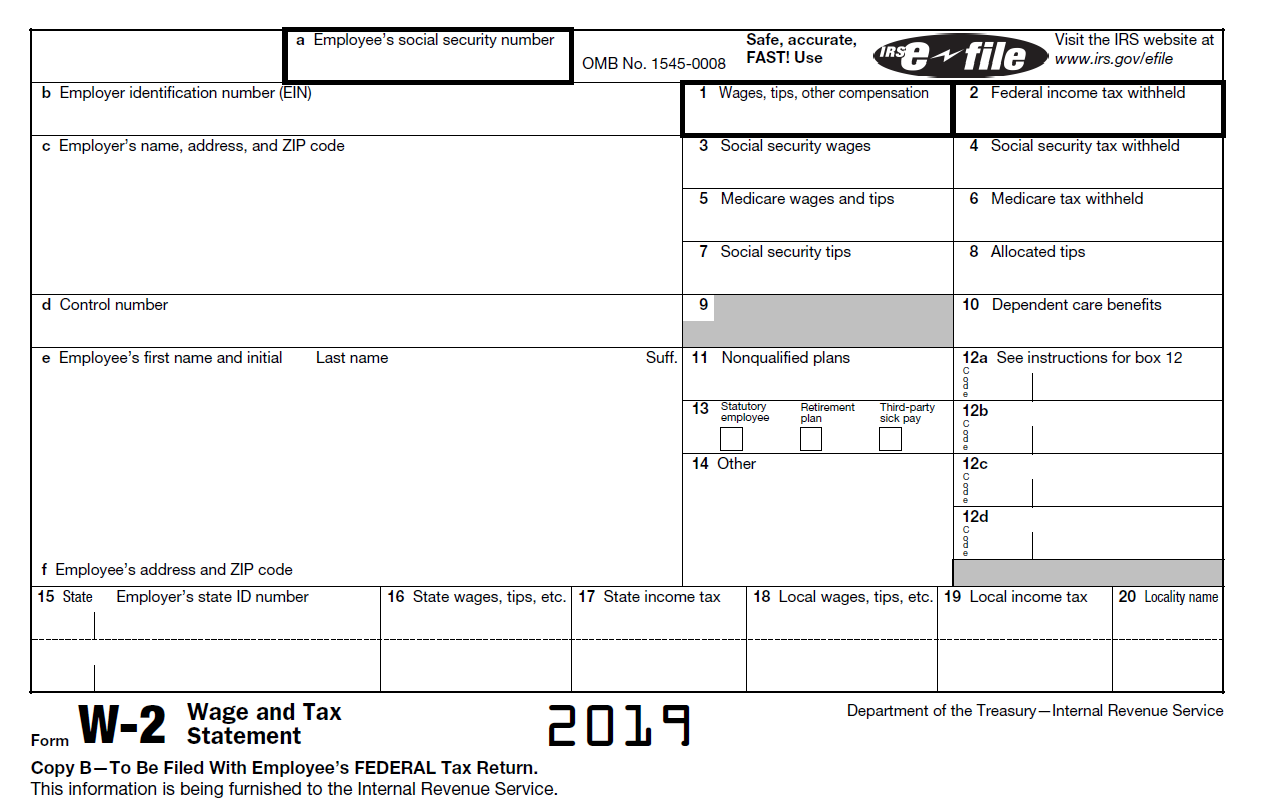

2019 IRS Form W 2: Downloadable and Printable CPA Practice Advisor

Source : www.cpapracticeadvisor.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

W 2 Deadline, Penalties, & Extension for 2023/2024 | CheckMark

Source : blog.checkmark.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

IRS Form 5498: IRA Contribution Information

Source : www.investopedia.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Tax filing season comes with changes for taxpayers

Source : www.graydc.com

3.11.13 Employment Tax Returns | Internal Revenue Service

Source : www.irs.gov

Irs Letter 12c 2024 Form 12c Download Excel Fill Online, Printable, Fillable, Blank : The IRS on Thursday announced higher inflation adjustments for the 2024 tax year, potentially giving Americans a chance to increase their take-home pay next year. The higher limits for the federal . The big picture: The new tax adjustments apply to tax returns filed in 2025 and the IRS also changed 2024 tax withholding tables, which determine how much money employers should withhold from employee .

:max_bytes(150000):strip_icc()/Form5498-135715bd358f41ed99042ea66213b504.png)

/do0bihdskp9dy.cloudfront.net/11-22-2022/t_e15593cbbb9742d398de17662808558d_name_BC_tax_00_00_41_19_Still001.jpg)